401k to roth 401k conversion calculator

Traditional or Rollover Your 401k Today. Traditional 401 k and your Paycheck.

5 Times A Roth 401k Conversion Is A Good Idea Above The Canopy

Roth 401k Conversion Calculator With the passage of the American Tax Relief Act any 401k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401k.

. 401k to roth conversion calculator. Roth IRA Conversion Calculator Use this calculator to compare the projected after-tax value of your Traditional IRA or 401k to the. Ad Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K.

Reviews Trusted by Over 45000000. 401k IRA Rollover Calculator. Compare 2022s Best Gold IRAs from Top Providers.

Roth 401 k Conversion Calculator. Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement. The Roth IRA conversion and designated Roth 401k conversion media storm is in full swing. Use this Roth IRA conversion calculator to project the inflation-adjusted value of your Traditional IRA or 401k at retirement versus the inflation-adjusted value of the same funds at retirement.

As of January 2006 there is a new type of 401 k contribution. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k. Learn How We Can Help Design 401k Plans For Your Employees.

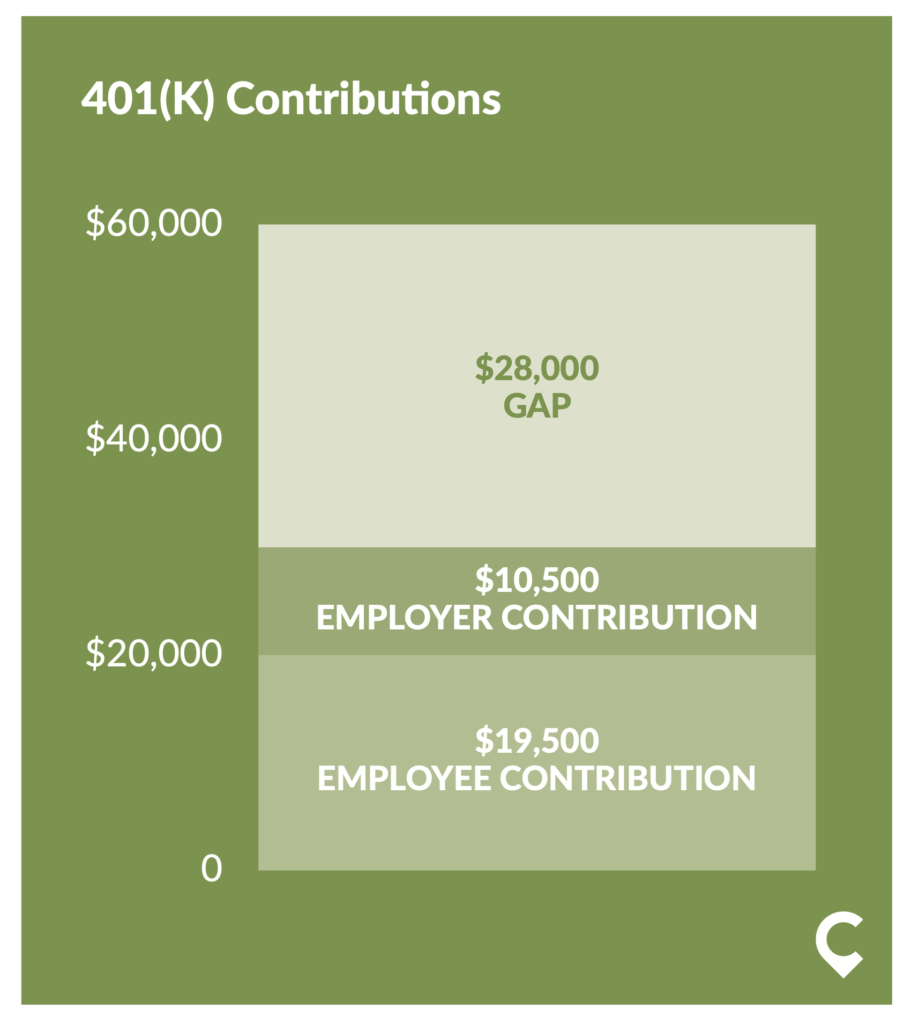

This calculator will show the advantage if any of converting your pre-tax 401 k to a Roth 401 k. 19500 or 26000 in 2021 or 20500 in 2022 with the 6500 catch-up amount. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Get Up To 600 When Funding A New IRA.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. The contribution limits on a Roth 401 k are the same as those for a traditional 401 k. Roth 401 k Conversion Calculator.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k. A 401 k can be an effective retirement tool.

The terms of a registered pension plan that detail the specific amounts that an employer and employee contribute to the plan. Roth Conversion Calculator Methodology General Context. Ad Open an IRA Explore Roth vs.

Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing. Because you pay the conversion tax in advance you also eliminate the income tax your current heirs would in any other case have to pay out on withdrawals. The Sooner You Invest the More Opportunity Your Money Has To Grow.

Make a Thoughtful Decision For Your Retirement. Roth 401 k Conversion Calculator. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA.

This calculator will help you to compare the net effects of keeping your traditional Individual Retirement Account. Use the tool to compare estimated taxes when you do. Roth IRA Conversion Calculator to Calculate Retirement Comparisons.

With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Your IRA could decrease 2138 with a Roth.

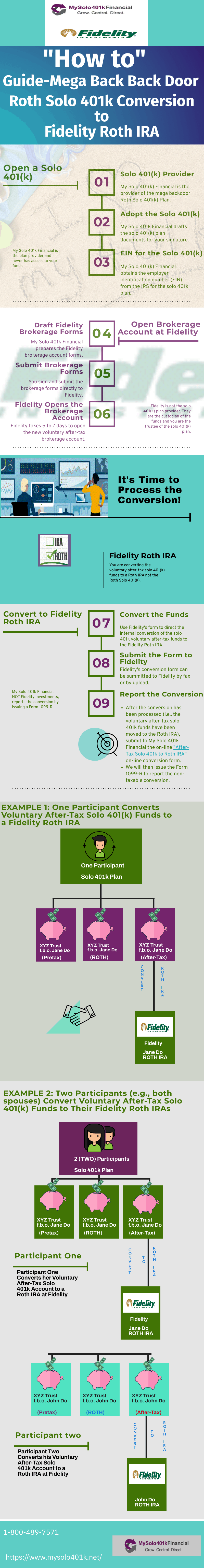

A 401 k can be an effective retirement tool. For some converting traditional retirement account assets into Roth accounts can. A backdoor Roth 401 k conversion is the transfer of both the pretax and after-tax contributions in a regular 401 k account to an employer-designated Roth 401 k account.

2022 Roth Conversion Calculator. Colorful interactive simply The Best Financial Calculators. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

This calculator can help you make informed decisions about performing a Roth conversion in 2022. Roth 401 k contributions allow. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Additional Roth Ira Calculators.

Ad Explore Your Choices For Your IRA. For some investors this could prove. By Aug 30 2022 oracle cloud database services 2021 specialist electric stair climbing hand truck for sale.

Traditional vs Roth Calculator. With the passage of the American Tax Relief Act any.

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

Roth 401k Roth Vs Traditional 401k Fidelity

Understanding The Mega Backdoor Roth Ira Roth Ira Roth Ira Conversion Ira

High Earners To Roth 401 K Or Not Greenleaf Trust

After Tax 401 K Contributions Retirement Benefits Fidelity

Roth Ira Conversion Calculator Excel

Your Guide To The Mega Backdoor Roth Case Study Free Flow Chart

The Ultimate Roth 401 K Guide District Capital Management

5 Times A Roth 401k Conversion Is A Good Idea Above The Canopy

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

The Average 401k Balance By Age Personal Capital

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Calculator

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work