Employer contribution payroll tax calculator

How frequently you are paid by your employer. Social Security 62 of an employees annual salary 1 Medicare 145 of an employees annual salary 1.

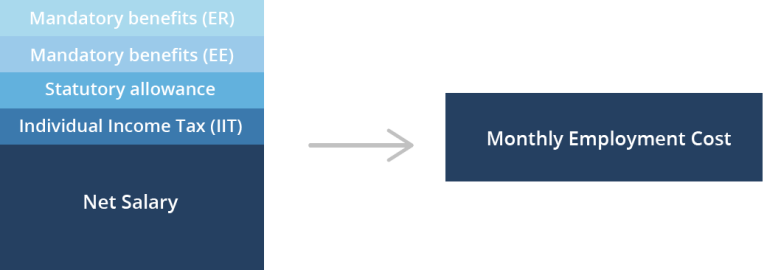

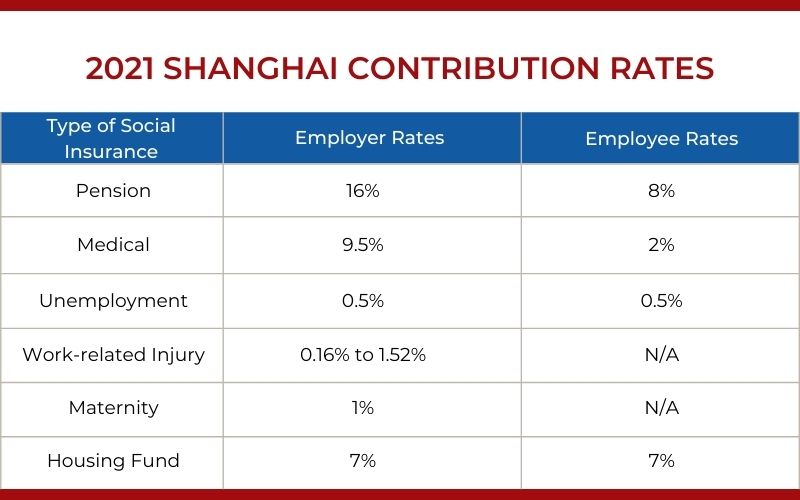

Best Payroll In China Guide 2022 Structure And Calculation Hrone

Over 900000 Businesses Utilize Our Fast Easy Payroll.

. It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Learn About Payroll Tax Systems. After you have determined that you are an employer a trustee or a payer and have opened a payroll program.

2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion Missouri Individual Income Tax. 368 25 92. Ad Keep your finances organized and compliant with government regulations.

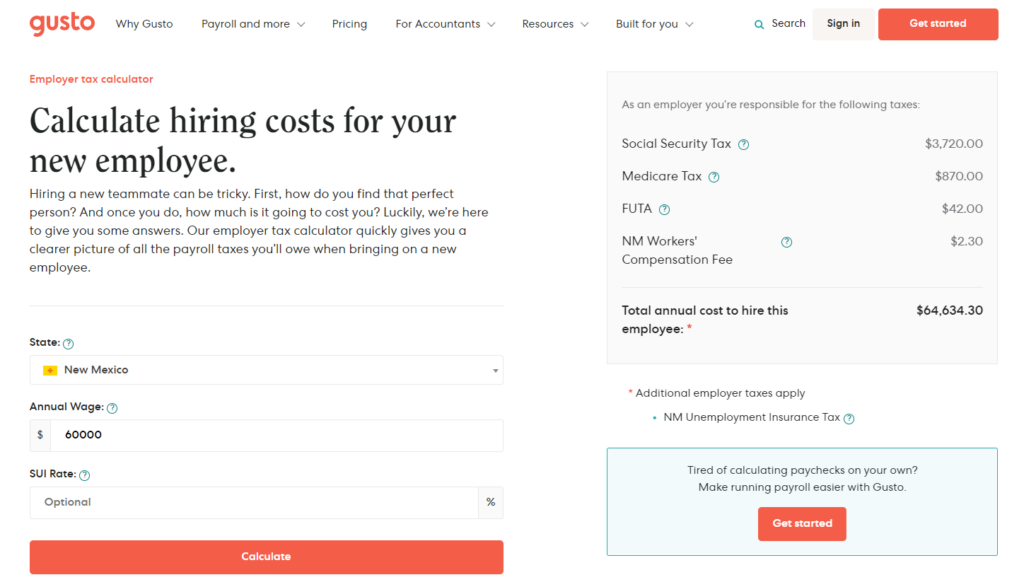

If a companys reported number of employees divided by the maximum PPP range amount per the SBA is greater than 100000 the estimated maximum PPP loan received by the company can. All Services Backed by Tax Guarantee. In the following boxes youll need to enter.

Sign Up Today And Join The Team. Because of the wage base the maximum amount an employer contributes per employee for 2021 is 913920 142800 X 62. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Free Unbiased Reviews Top Picks. Ad Compare This Years Top 5 Free Payroll Software. 2020 Federal income tax withholding calculation.

Ad Compare This Years Top 5 Free Payroll Software. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Kansas City Earnings Tax.

What are some of the payroll taxes that employers pay. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Learn About Payroll Tax Systems.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Changes to the rules for deducting Canada Pension Plan CPP contributions. How to File Your Payroll Taxes 1 Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

Easy to use software that is tailored specifically for small businesses. Subtract 12900 for Married otherwise. In this week 25 of the disposable earnings may be garnished.

Withhold 62 of each employees taxable wages until they earn gross pay. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and. After deductions required by law the disposable earnings are 368.

2 Prepare your FICA taxes Medicare and Social Security monthly or semi. To calculate Missouri taxable income taxpayers take their federal adjusted gross income AGI and then subtract or add certain types of income. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Gross Pay Calculator Plug in the amount of money youd like to take home each pay period and this. Sign Up Today And Join The Team. The charts below show the employer contribution rates while our contribution calculator helps you to estimate how this will look for you and your Massachusetts workforce.

This free online tool calculates gross pay based on take-home pay while also allowing for adjustments for retirement contributions insurance premiums and more. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. All Services Backed by Tax Guarantee.

Free Unbiased Reviews Top Picks. Your annual gross salary. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

An employee paid every other. Over 900000 Businesses Utilize Our Fast Easy Payroll. To contact the Kansas City.

Your expected annual pay increases if any. Take a look at an example.

How To Calculate Payroll Taxes In 5 Steps

Paycheck Calculator Take Home Pay Calculator

Best Payroll In China Guide 2022 Structure And Calculation Hrone

How To Calculate Payroll Taxes Wrapbook

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Are Employer Taxes And Employee Taxes Gusto

Paycheck Calculator Take Home Pay Calculator

6 Free Payroll Tax Calculators For Employers

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

How To Calculate Payroll Taxes In 5 Steps

Employer Payroll Tax Calculator Incfile Com

New York Hourly Paycheck Calculator Gusto

Payroll Tax What It Is How To Calculate It Bench Accounting

Different Types Of Payroll Deductions Gusto

Payroll Tax Calculator For Employers Gusto

Payroll Tax Savings Calculator Lively